ev charger tax credit 2021 california

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Residents who buy qualifying residential fueling equipmentincluding electric vehicle charging stationsbefore the end of the calendar year might be eligible for a tax credit of up to 1000 see IRS Form 8911 for additional information.

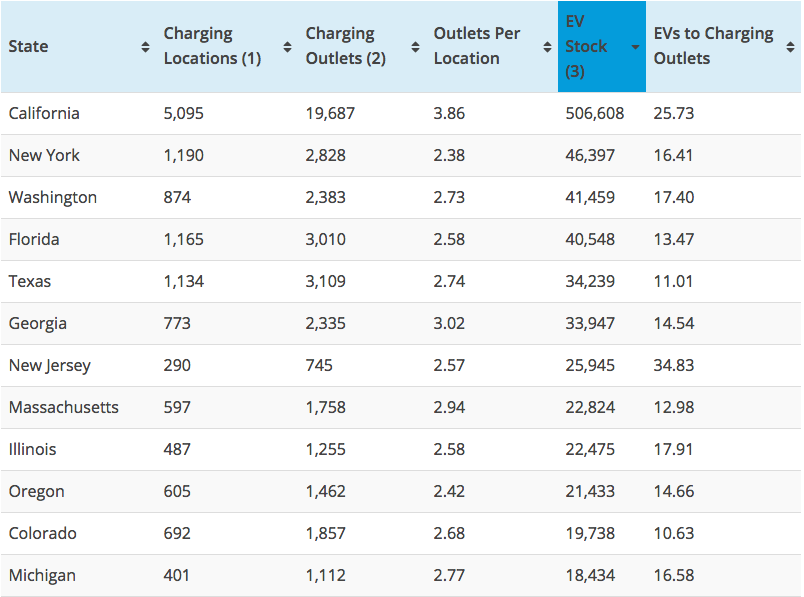

What Is The Minimum Acceptable Ratio Of Evs To Charging Stations Evadoption

A qualified taxpayer would be allowed a maximum credit for installations during the taxable year of.

. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. Look Up California EV Incentives By Zip Code. If so we have great news for you.

Purchasers of the report will also receive the raw data in an Excel file. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand. The tax credit is retroactive and you can apply for installations made from as far back as.

4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles PHEVs and 750 for zero emission motorcycles. See a list at DriveClean Electric for All and. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. In some cases these rebates can cover around 70 of total costs. 500 per Level 2 vehicle supply equipment and 2500 per direct current fast charger.

Californias Electric Car Incentives 2021. This incentive covers 30 of the cost with a maximum credit of up to 1000. Congress recently passed a retroactive federal tax credit for those who purchased.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Pasadena Water and Power customers can receive up to 1500 rebate for buyingleasing an EV and businesses can receive up to 50000 for installing public EV chargers Rancho Cucamonga Municipal Utility RCMU offers residents living in the service area a rebate up to 500 to install a Level 2 charger in their homes.

7000 for FCEVs 4500 for EVs 3500 for PHEVs. The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in California. The tax credit is retroactive and you can apply for installations made from as far back as.

Additional incentives could be available in your ZIP code. A good rule of thumb for people thinking of purchasing an EV. Treasurer Launches Innovative Program to Finance.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. It covers 30 of the costs with a maximum 1000. Bill Analysis Bill Number.

Purchasing an EV Charging Station in 2021. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Grab IRS form 8911 or use our handy guide to get your credit.

There are many many EV charging station rebates available in California. We try to maintain this page regularly but another resource that may. This report based on data from Electrify Americas Q3 2021 California report includes key findings analysis and 14 charts.

The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience. Permitting and inspection fees are not included in covered expenses. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure.

For low to moderate-low-income to moderate-income buyers. The tax credit now expires on December 31 2021. The San Joaquin Valley Incentive Project offers rebates of up to 3500 per Level 2 Charger and up to 70000 per DC Fast Charger.

Purchasing an EV Charging Station in 2021. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchase d EV charging infrastructure. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles Orange.

The federal tax credit was extended through December 31 2021. Hey Californians so youve decided that you wanted to switch to an electric car. The program was funded through the California Energy Commission and operated from June 1 2015 through March 31 2022.

You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000. Receive a federal tax credit of 30 of the cost of. Beginning on January 1 2021.

To qualify you must be a site owner or their authorized agent and be a business nonprofit California Native American Tribe or a public entity. Ad Incentives Subscription Pricing Make EV Charging With More Affordable Than Ever. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

Just buy and install by December 31 2021 then claim the credit on your federal tax return. Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31 2021 is eligible for a tax credit of 30 of the cost not to exceed 30000. Or maybe you already own an electric car and youre wondering what incentives you rate as an electric car owner.

45 rows The following table shows the Federal tax credit and California CRVP rebate amount available for BEVs and PHEVs currently for sale in the US. Federal EV Charger Incentives. Residential installation can receive a credit of up to 1000.

Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI. These rebates help bring down the capital expenditure making installing charging stations a very interesting project for many hotels workplaces or apartment complexes. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. These amounts are for Federal tax credits effective January 1 2020 and California CRVP rebates effective December 3 2019 when several changes were made to that program. Have a question on the report before you buy send us.

More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV vehicles including utility discounts on chargers and electricity rates. Well many EV owners are not aware of the benefits they can potentially rate for being an electric car owner. That could be worth around 15000.

Up to 1000 Back for Home Charging. If youre considering installing an electric charging station in your home remember that the process will likely require obtaining. It covers 30 of the cost for equipment and installation up to 30000.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. And April 7 2021.

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Electric Vehicle Charging Stations Facility Solutions Group

Guide To Home Ev Charging Incentives In The United States Evolve

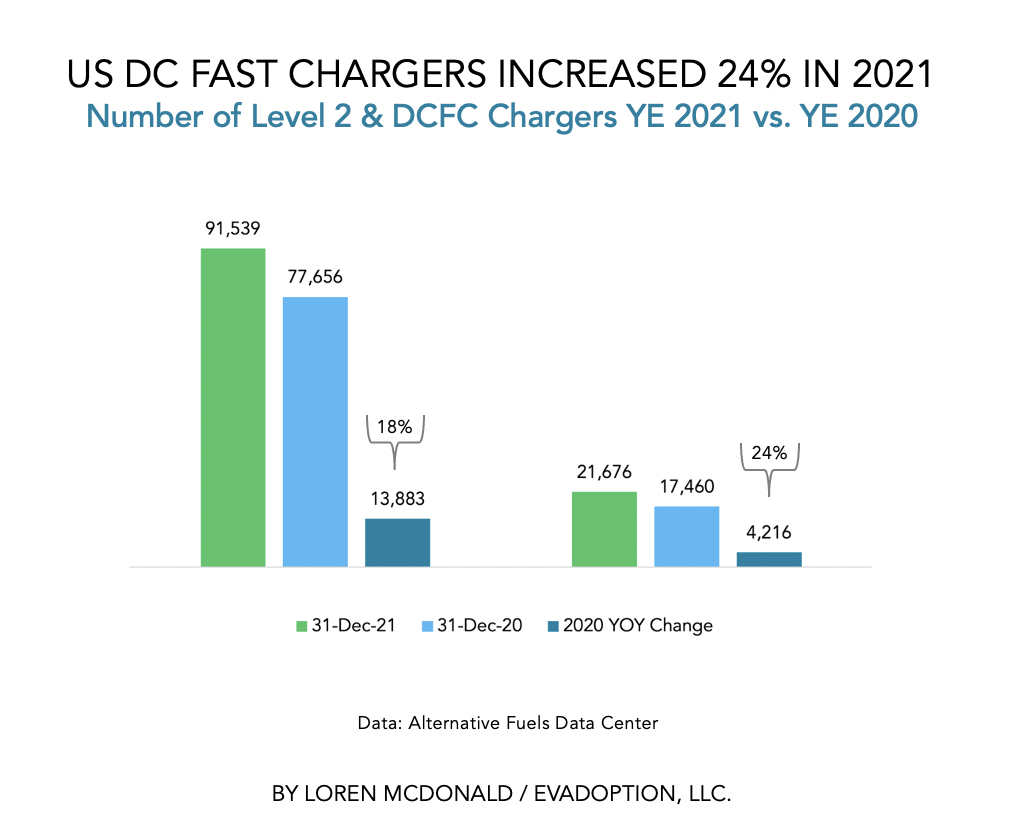

Ev Charging Statistics Evadoption

How To Extinguish Electric Vehicles Fire Step By Step Video Guide E Mobility Simplified Basics Of Electric Vehicles Electric Cars Vehicles High Voltage

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electrify Your Ride Program 3ce

2021 Ford Mustang Mach E California Rt 1 Suv Model Details Specs Ford Mustang Mustang Ford

State Electric Vehicle Charging Guide

Tax Credit For Electric Vehicle Chargers Enel X

States Get Go Ahead To Build Electric Car Charging Stations San Bernardino Sun

Anaheim Public Utilities Incentives

How To Claim An Electric Vehicle Tax Credit Enel X

Residential Ev Charging Stations Rebate

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Federal Charging And Ev Incentives Chargepoint

U S Ev Charging System A Priority Under Biden S 2 Trillion Infrastructure Plan