property tax rates philadelphia suburbs

Property Tax Calculator - Estimate Any Homes Property Tax. To find more detailed property tax statistics for your area find your county in the list on your states page.

Best Philadelphia Suburbs To Live In 2022 List Tips Data Map

Collingdale has been my suburb for nearly a decade and the neighborhood is filled with men and women who keep to themselves--one could consider that a blessing--but a unionized neighborhood would be better.

. The annual school district tax bill for their home is nearly 6500 after the Coatesville Area School District board approved a 39 increase for the 2019-20 school year. Countywide increases approved in December affect the owners of all 382304 real estate. Now consider you live in the suburbs but also work in a Philadelphia suburb.

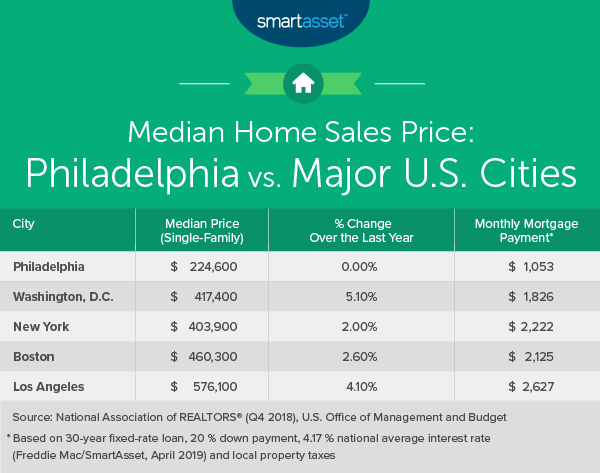

That rate applied to a home worth 239600 the county median would result in an annual property tax bill of 5075. The Tax Foundation study was based on median property taxes paid within counties in 2018 based on five-year estimates. Real estate and sales taxes are other financial considerations.

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. Overall the average property-owning income-earning resident is likely to pay higher taxes in New Jersey than in Pennsylvania. The states average effective rate is 242 of a homes value compared to the national average of 107.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Some key metrics for each state include. The countys average effective property tax rate is 212.

In Philadelphia the average residential tax burden declined between 2000 and 2012 from 107 percent of income to 98 percent. The median property tax also known as real estate tax in Philadelphia County is 123600 per year based on a median home value of 13520000 and a median effective property tax rate of 091 of property value. The family paid about 1170 more in major state and local taxes in 2015 than it did in 2000.

Factoring in state income taxes the hypothetical familys total state-and-local tax burden fell from 135 percent to 129 percent. In the six years they have owned the house school taxes have increased more than 20 and their districts tax rates are among the highest in. Tax rate 13998 of the assessed property value.

Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. Typically the owner of a property must pay the real estate taxes. Situated along the Delaware River between the state of Delaware and the city of Philadelphia Delaware County has the second highest property tax rate in Pennsylvania.

Hundreds of thousands of property owners in Bucks Chester Delaware and Montgomery Counties are getting something they probably dont want in the new year higher real estate taxes. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. -13 In the above chart with number provided by the Office of the City Controller residents can see how Philadelphia real estate taxes compare with a select group of suburbs.

Tax rates differ depending on which specific town or county youre a part of so its difficult to do a side-by-side comparison of all Philadelphia PA suburbs and all New Jersey suburbs. Ad Find Out the Market Value of Any Property and Past Sale Prices. Median Property Tax Median Home Value Home Value Median Income Income.

121 7490 116 7210 976360 1217530 1096770 In New Jersey the suburban familys tax burden rose to 109 percent in 2012 and 121 percent in 2015 as property assessments rose faster than income. Search and Pay your Real Estate Taxes. Median Property Tax Rates By State Ranked highest to lowest by median property tax as percentage of home value 1 1 New Jersey 189 2 New Hampshire 186 3 Texas.

7 Suburbs with the Lowest Cost of Living in Philadelphia Area. Effective tax rate Philadelphia County 00098 of Asessed Home Value Pennsylvania 00158 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Philadelphia County 1602 Pennsylvania 2852 National 2471 Median home value Philadelphia County 163000 Pennsylvania 180200 National 217500 Median income. Rating 413 out of 5.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Most Philadelphia suburbs in PA impose a local Earned Income Tax which can be as much as 2. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Who pays the tax Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. While the Philadelphia Wage Tax may be 2-4 times higher than the suburbs Philadelphias real estate taxes are generally lower than the. Theres just one problem.

A mill is amount of tax per thousand dollars of property value. The Center Square Chester County residents on average paid 5177 annually in property taxes the highest such tax levies among all regions of Pennsylvania according to a new Tax Foundation analysis. A Narrowing Gap between Philadelphia and its Suburbs Specifically our study found.

So a property with an assessed value of 500000 would owe 796950 in property taxes One thing to note is that while Philadephias property tax is 8264 mills the assessed values of most properties is much lower than the actual market value so property tax amounts are generally lower. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax.

Moving In Philadelphia Guide To Philadelphia Neighborhoods

Pin On 5 The Philadelphia Editor 2018 Edition

Nj Or Pa Philadelphia Suburbs The First Time Homeowners Dilemma

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Nfl Stadiums Map Poster Etsy Nfl Stadiums Map Poster Nfl

3355 Mary St Drexel Hill In 2021 Philadelphia Real Estate Drexel Hill Real Estate

Booking Com Hampton Inn By Hilton Concord Bow Concord Usa 157 Guest Reviews Book Your Hotel Now Hampton Inn The Hamptons Inn

Pittsburgh Vs Philadelphia 2022 Comparison Pros Cons Which City Is Better

Philadelphia County Pa Property Tax Search And Records Propertyshark

Philadelphia County Pa Property Tax Search And Records Propertyshark

9 Of The Most Famous Family Properties On The Market Linden Hills Mansions Estate Homes

Pennsylvania Property Tax Calculator Smartasset

How You Find Low Mortgage Rates In Philadelphia Lowmortgagerates Lowest Mortgage Rates Mortgage Lenders Credit Repair Services

The Cost Of Living In Philadelphia Smartasset

A Guide On Property Tax Property Tax Tax Refund Types Of Taxes

Property Taxes 101 Estate Tax Property Tax Tax Deductions

2022 Suburbs Of Philadelphia Area With The Lowest Cost Of Living Niche

Strategic Overview 143 Summit Street Brooklyn Ny Featuredproperty Of National Realty Investment Advisors Real Estate Investing Investment Advisor Realty